Are you looking for DAV Maths Solutions for class 8 then you are in right place, we have discussed the solution of the Secondary Mathematics book which is followed in all DAV School. Solutions are given below with proper Explanation please bookmark our website for further update !! All the Best !!

Unit 5 Brain Teaser | Profit and Loss | DAV Solutions Class 8 Secondary Mathematics

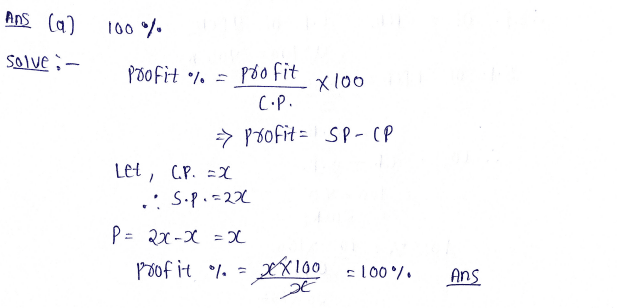

Q1A. Tick the correct option.

(i) If the selling price of an article is twice the cost price, the profit percent is

(a) 50% (b) 100% (c) 150% (d) 200%

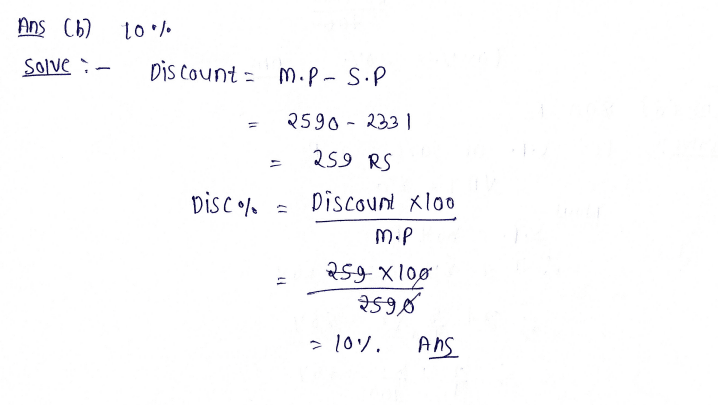

(ii) A jeans is marked for Rs. 2,590, but is sold for Rs 2,331, then discount % is

(a) 20% (b) 15% (c) 10% (d) 5%

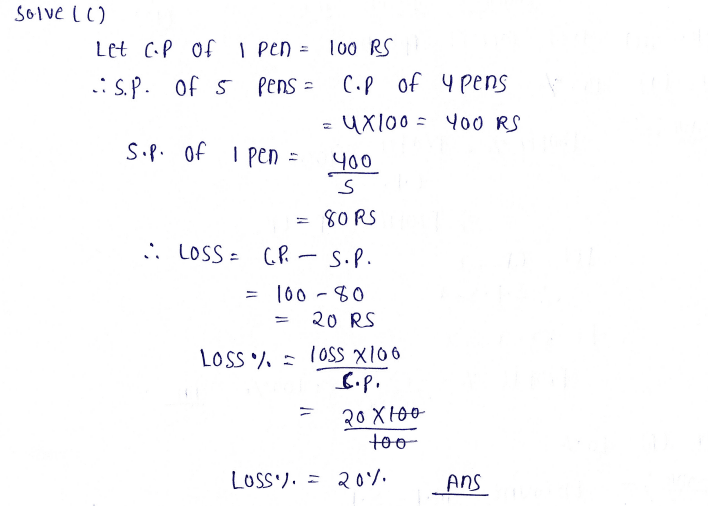

(iii) If selling price of five pens is equal to the cost price of four pens, then the gain or loss% is

(a) 20% gain (b) 20% loss (c) 25% loss (d) 25% gain

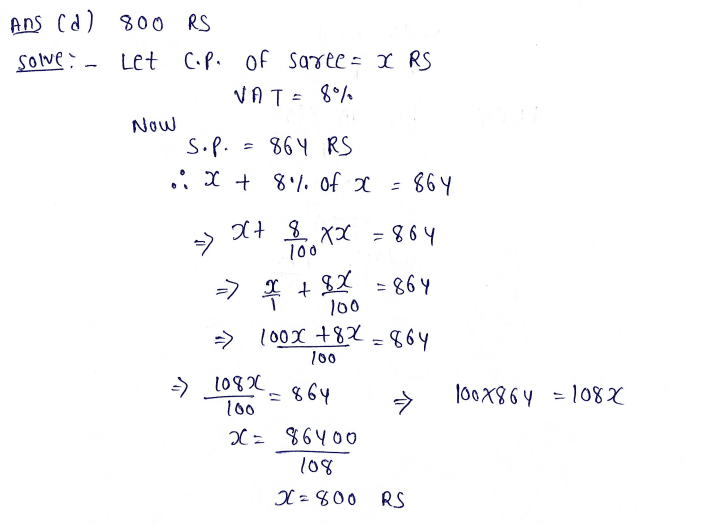

(iv) Selling price of a saree is Rs. 864 including 8% VAT. The original price of the saree is

(a) Rs. 842 (b) Rs. 800 (c) Rs. 801.50 (d) Rs. 820

(v) Discount is always calculated on

(a) cost price (b) marked price (c) selling price (d) VAT

Q1B. Answer the following questions.

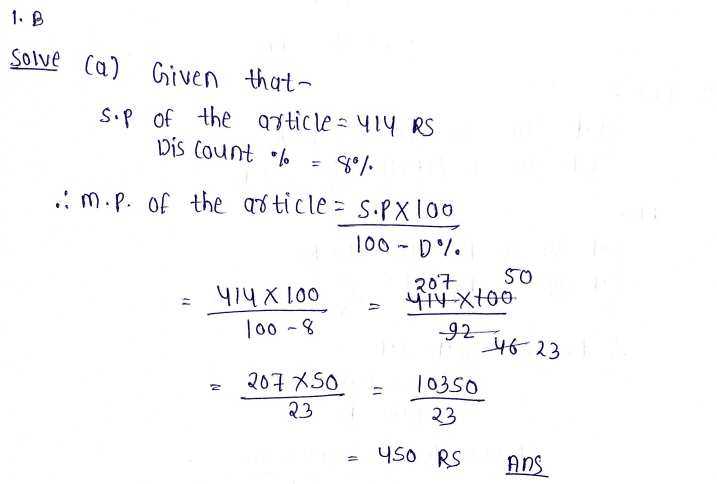

(i) After giving a discount of 8% on the marked price, an article was sold for Rs. 414. Find the marked price of the article.

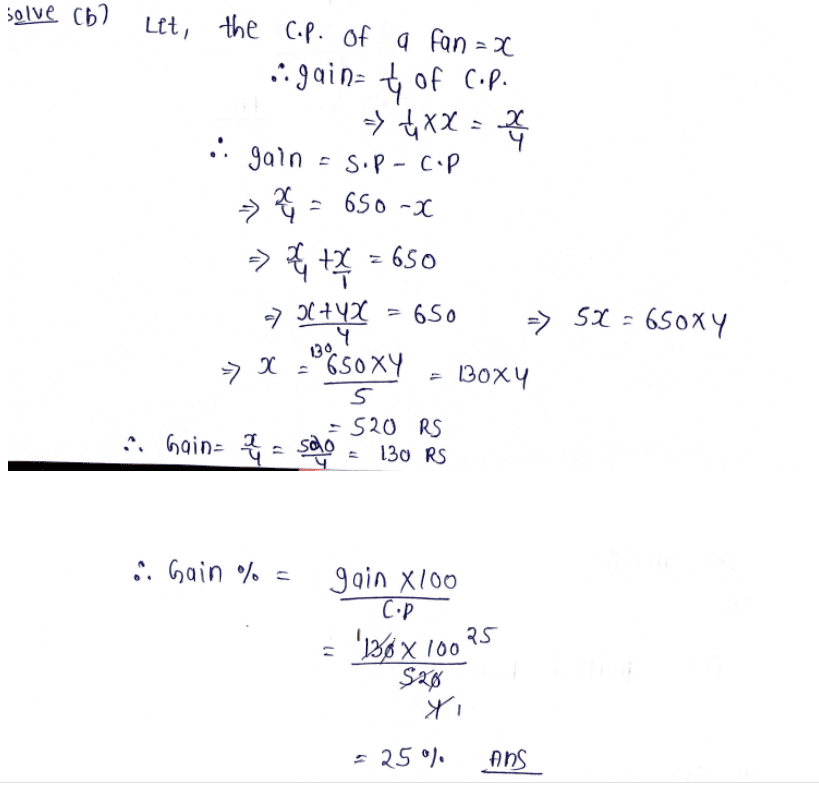

(ii) A fan is sold for Rs. 650. The gain is one-fourth of the cost price of the fan. Find the gain per cent.

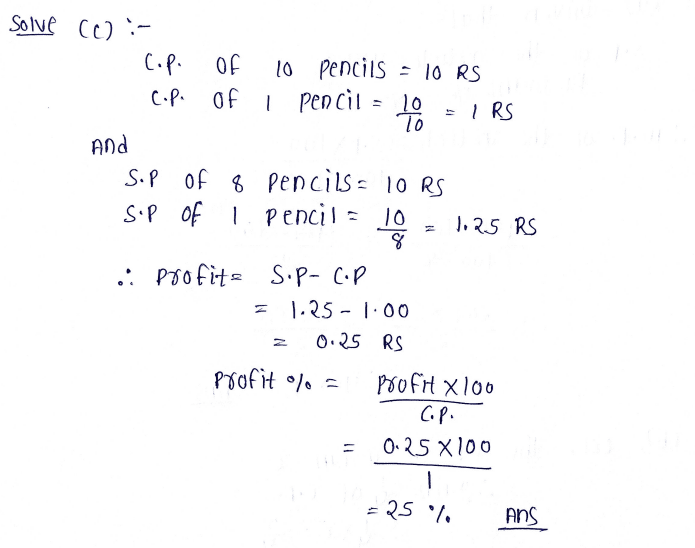

(iii) A shopkeeper buys pencils at 10 for Rs. 10 and sells them at 8 for Rs. 10. Find the profit per cent.

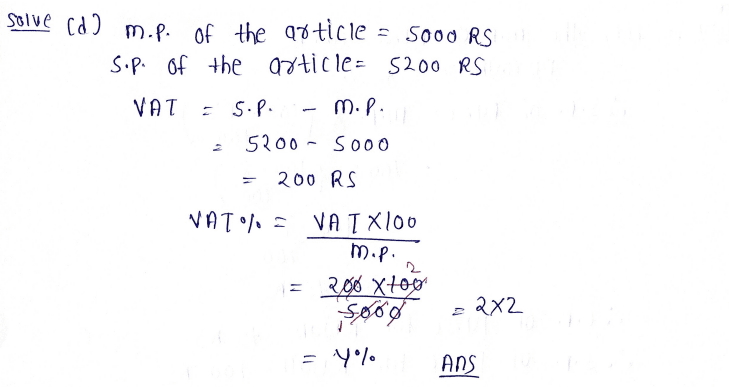

(iv) Find the rate of VAT if an article marked at Rs. 5000 is sold for Rs. 5200?

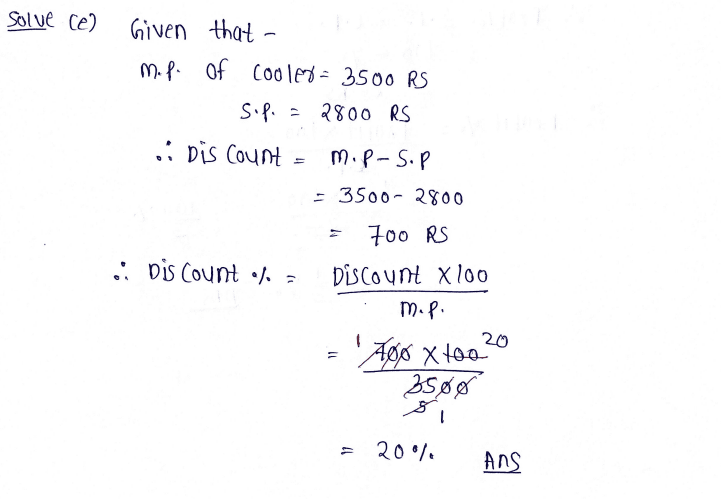

(v) A person pays Rs. 2800 for a cooler marked at Rs. 3500. Find the discount per cent offered.

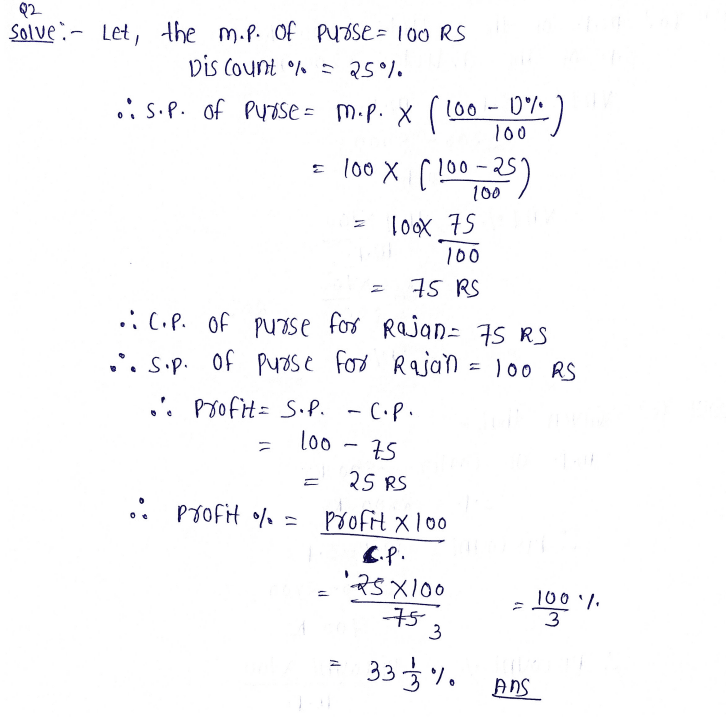

Q2. Rajan purchased a purse at 25% discount on its marked price but sold it at the marked price. Find the gain per cent of Rajan on this transaction.

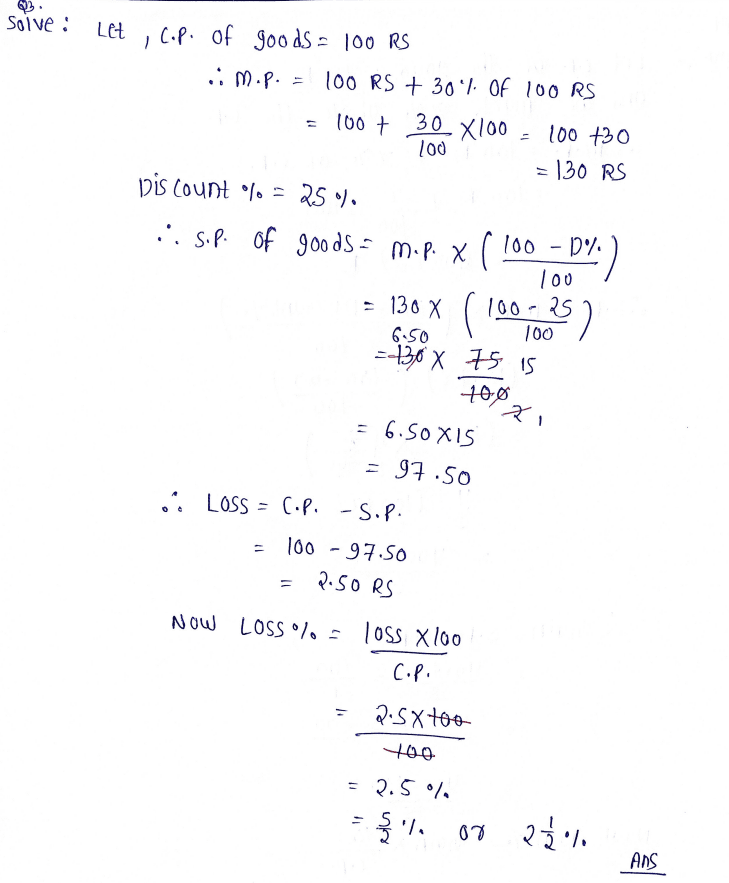

Q3. Jasleen marks her goods at 30% above the cost price and allows a discount of 25% on the marked price. Find her gain or loss per cent.

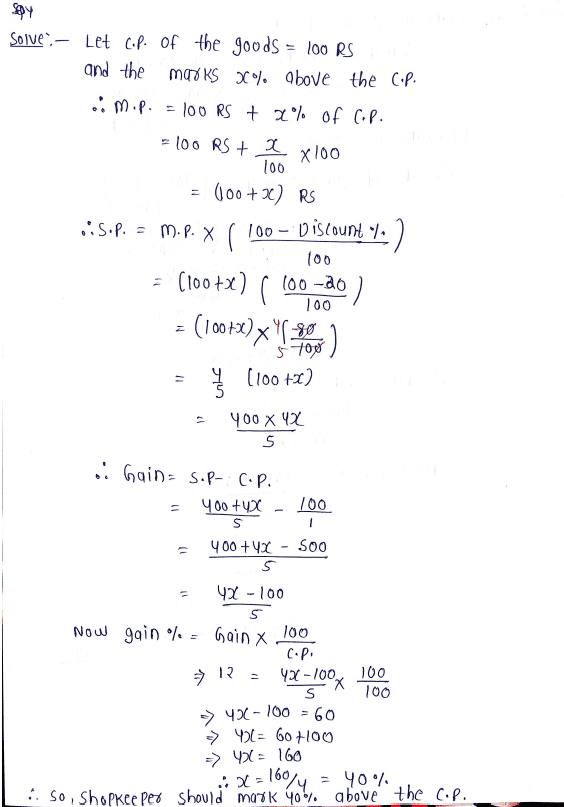

Q4. How much per cent above the cost price should a shopkeeper mark his goods so that after allowing a discount of 20% on the marked price, he gains 12%?

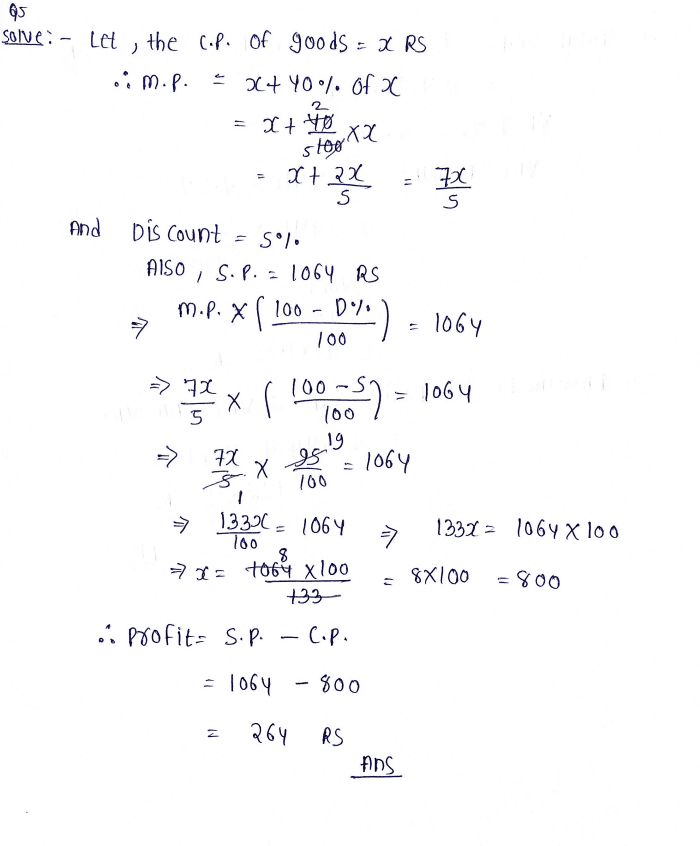

Q5. Rohit marks his goods at 40% above the cost price but allows a discount of 5% for cash payment to his customers. What actual profit does he make, if he receives Rs. 1,064 after allowing the discount?

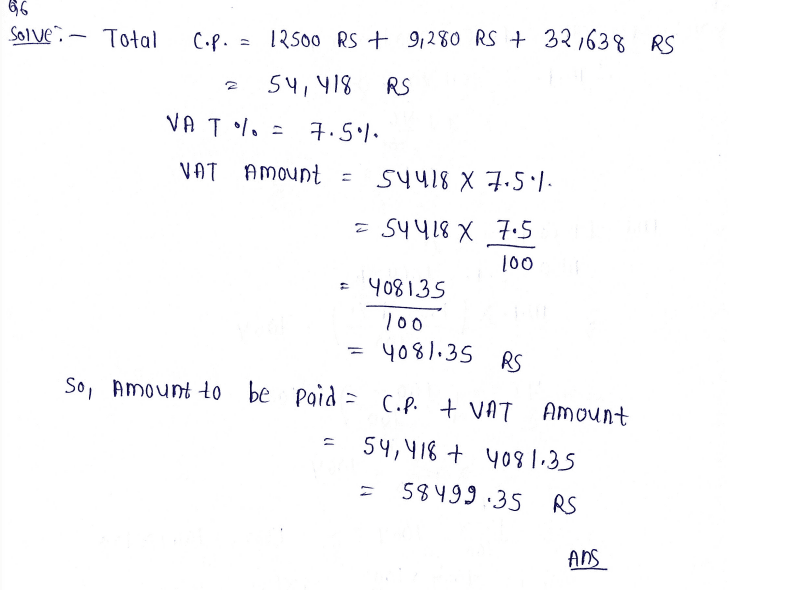

Q6. Mr Kumar went to shopping with his family to a Mall, Mrs Kumar bought a saree for Rs. 12,500, clothes for the kids for Rs. 9,280 and a mobile for Mr Kumar for Rs. 32,638. If the VAT charged on their purchases is 7.5%, then what is the total amount that Mr Kumar has paid?

It’s helpful

Thank you & it’s helpful