The Income tax calculator is an easy-to-use online tool that helps you estimate your taxes based on your income after the Union Budget is presented. We have updated our tool in line with the income tax changes proposed in the Union Budget 2023-24.

Income Tax Calculator

Revised Income tax slabs under new tax regime for FY 2023-24 (AY 2024-25

The income tax slabs under the new income tax regime will be as follows considering you salaried or a pensioner :

| Income tax slabs under new tax regime | Income tax rates under new tax regime |

| O to Rs 3 lakh | 0 |

| Rs 3 lakh to Rs 6 lakh | 5% |

| Rs 6 lakh to Rs 9 lakh | 10% |

| Rs 9 lakh to Rs 12 lakh | 15% |

| Rs 12 lakh to Rs 15 lakh | 20% |

| Income above Rs 15 lakh | 30% |

How to use the New Regime Income tax calculator for FY 2023-24

Following are the steps to use the tax calculator:

1. Enter your total salary without availing exemptions such as HRA, LTA, professional tax

2. Click on ‘Go to Calculate Tax ‘ .

New Tax Regime – Complete list of exemptions and deductions not allowed

Let us now look into the exemptions and deductions not allowed under the Sec.115BAC,

- Leave travel concession (LTC) applicable for salaried employee

- House Rent Allowance (HRA) applicable for salaried employee

- The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer opts for section 115BAC. Note – As per Budget 2023, effective from 1st April 2023, this deduction is available under the new tax regime.

- Deduction of entertainment allowance and professional tax.

- Deductions under Sec.80C like Life Insurance Premium, Sum Paid towards deferred annuity plans, your contributions towards EPF, PPF, Superannuation Scheme, SSY, NSC, ELSS Mutual Funds, Tuition Fees, Principal Payment towards your home loan, Tax Saving FDs, SCSS, Contribution to NPS Tier 2 by Central Government Employees, NPS contribution by you (Under Sec.80CCD(1) and Sec.80CCD(1B). But employer contribution under Sec.80CCD(2) will continue to be eligible for deduction.

- Deduction under Sec.80D- Amount paid (in any mode other than cash) by an individual or HUF to LIC or other insurers to effect or keep in force an insurance on the health of a specified person.

- Section 80DD – Deduction in respect of maintenance including medical treatment of a dependant who is a person with a disability.

- Section 80DDB – Expenses actually paid for medical treatment of specified diseases and ailments.

- Section 80E – Amount paid out of income chargeable to tax by way of payment of interest on loan taken from financial institution/approved charitable institution for pursuing higher education

- Section 80EE – Interest payable on loan taken up to Rs. 35 lakhs by the taxpayer from any financial institution, sanctioned during the FY 2016-17, for the purpose of acquisition of a residential house property whose value doesn’t exceed Rs. 50 lakhs

- Section 80EEA – Interest payable on loan taken by an individual, who is not eligible to claim deduction under section 80EE, from any financial institution during the period beginning from 01/04/2019 ending on 31/03/2020 for the purpose of acquisition of a residential house property whose stamp duty value doesn’t exceed Rs. 45 lakhs

- Section 80EEB – Interest payable on loan taken by an individual from any financial institution during the period beginning from 01/04/2019 and ending on 31/03/2023 to purchase an electric vehicle.

- Section 80GG – Rent paid for furnished/unfurnished residential accommodation (Subject to certain conditions).

- Section 80G- Deduction in respect of donations to certain funds, charitable institutions etc

- Section 80GGA- Deduction in respect of certain donations for scientific research or rural development

- Section 80GGC- Deduction in respect of contributions given by any person to political parties

- Section 80JJA- Deduction in respect of profits and gains from business of collecting and processing of bio-degradable waste

- Section 80QQB- Royalty income of authors of a certain specified category of books other than text books.

- Section 80RRB- Royalty in respect of patents registered on or after 01.04.2003 (subject to certain conditions)

- Section 80TTA- Interest on deposits in savings account with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)

- Section 80TTB- Interest on deposits with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)- for senior citizens

- Section 80U- A resident individual who, at any time during the previous year, is certified by the medical authority to be a person with a disability

- Section 24(b) – In the case of personal taxpayers who have self-occupied the property for own residence or who cannot occupy the property owing to employment, business or profession carried on at any other place he has to reside at that other place in a building not belonging to him, the annual value of the property shall be taken to be `nil’. However, interest on money borrowed is deductible up to a maximum of Rs.2 lakhs.

- Allowances (Under Sec.10(14)) like Travelling/Transfer Allowance, Conveyance Allowance, Helper Allowance, Research Allowance or Uniform Allowance

- Any allowance granted to meet the expenditure incurred on a helper where such helper is engaged for the performance of the duties of an office or employment of profit;

- Any allowance granted for encouraging the academic, research and training pursuits in educational and research institutions;

- Any allowance granted to meet the expenditure incurred on the purchase or maintenance of uniform for wear during the performance of the duties of an office or employment of profit.

- Any Special Compensatory Allowance in the nature of [Special Compensatory (Hilly Areas) Allowance] or High Altitude Allowance or Uncongenial Climate Allowance or Snow Bound Area Allowance or Avalanche Allowance

- Any Special Compensatory Allowance in the nature of Border Area Allowance, Remote Locality Allowance or Difficult Area Allowance or Disturbed Area Allowance

- Special Compensatory (Tribal Areas/Schedule Areas/Agency Areas) Allowance

- Any allowance granted to an employee working in any transport system to meet his personal expenditure during his duty performed in the course of running of such transport from one place to another place provided that such employee is not in receipt of daily allowance

- Children Education Allowance

- Any allowance granted to an employee to meet the hostel expenditure on his child

- Compensatory Field Area Allowance

- Compensatory Modified Field Area Allowance

- Any special allowance in the nature of counter-insurgency allowance granted to the members of armed forces operating in areas away from their permanent locations

- Underground Allowance granted to an employee who is working in uncongenial, unnatural climate in underground mines

- Any special allowance in the nature of high altitude (uncongenial climate) allowance granted to the member of the armed forces operating in high altitude areas

- Any special allowance granted to the members of the armed forces in the nature of special compensatory highly active field area allowance

- Any special allowance granted to the member of the armed forces in the nature of Island (duty) allowance

- Section 10(17) – In the case of persons being Member of Parliament or any State Legislature or of any committee thereof any income by way of daily allowance or any allowance shall not be eligible for exemption when such person opts for section 115BAC.

- Section 10(32) – In case, the income of minors is clubbed with the income of the parent under section 64(1A), a sum of Rs.1500 is deducted by virtue of section 10(32). This deduction cannot be claimed by the parent who opts for section 115BAC.

- The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC.

- Deduction of entertainment allowance and professional tax.

List of tax deductions and allowances retained in the New Tax regime (section 115BAC)

Allowanes retained under Sec.115BAC are as below:-

- Transport Allowance granted to a divyang employee to meet the expenditure for the purpose of commuting between place of residence and place of duty.

- Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

- Any Allowance granted to meet the cost of travel on tour or on transfer;

- Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

List of deductions allowed under new tax regime are as below:-

- Retirement benefits, gratuity etc.

- commutation of pension

- leave encashment on retirement

- retrenchment compensation

- VRS benefits

- EPFO: Employer contribution

- NPS withdrawal benefits

- Education scholarships

- Payments of awards instituted in public interest

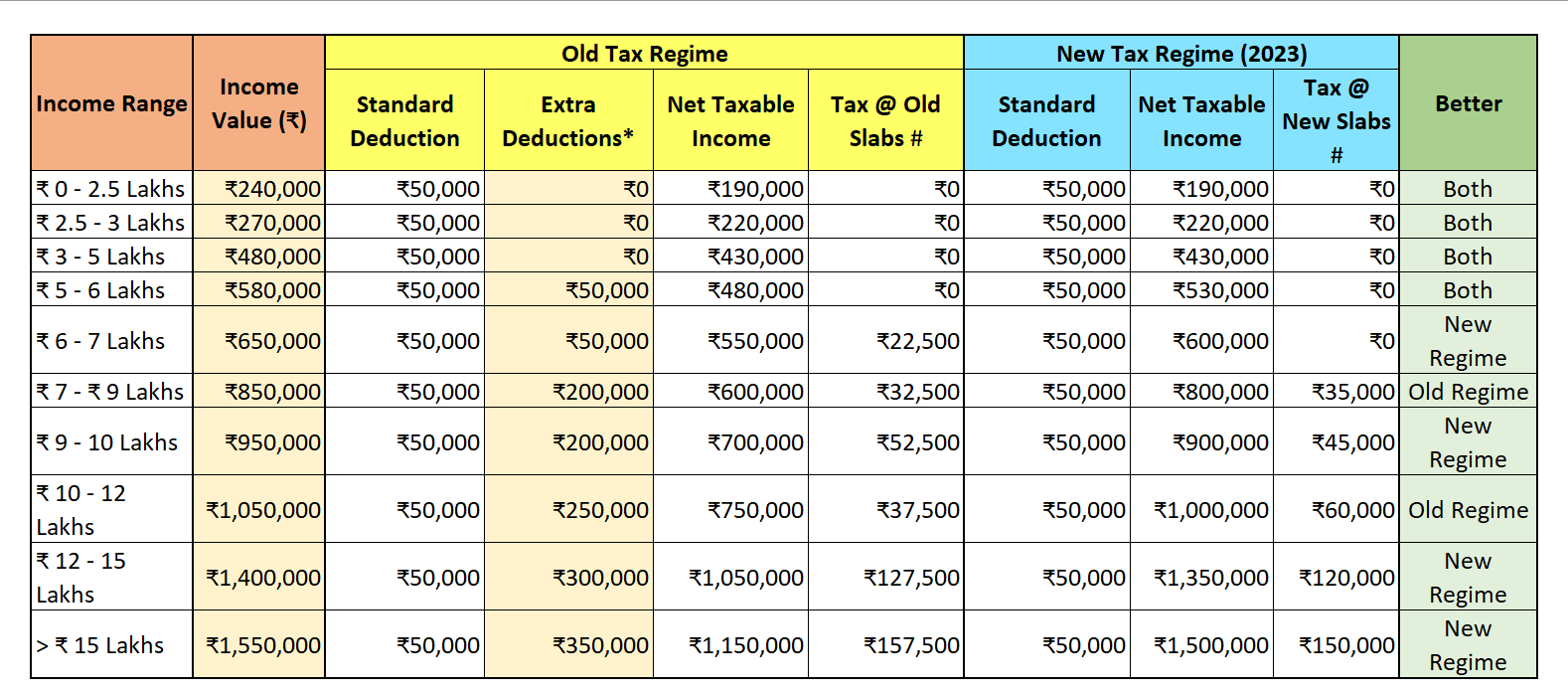

The new tax regime for FY 2023-24 (AY 2024-25) reduces the number of tax slabs from 6 to 5. Individuals with an annual income of 5-6 lakh will pay 5% tax, 6-9 lakh will pay 10% tax, 9-12 lakh will pay 15% tax, 12-15 lakh will pay 20% tax, and those earning more than 15 lakh will pay 30% tax. The new regime applies for income made in FY 2023-24.