Cash Flow Statements

AS3 Definition-The Standard deals with the provision of information about the historical changes in cash and cash equivalents of an enterprise by means of a Cash Flow Statement which classifies cash flows during the period from operating, investing and financing activities.

Which companies prepare cash flow statements ?

Cash flow is mandatory for Cash Flow Statement is required to be prepared by every company except a one person, small and dormant company. For non-companies – AS 3 is not mandatory for entities falling in Level II and Level III.

What is the definition of cash as per AS3 ?

Cash comprises cash on hand and demand deposits with banks. Cash equivalents are short term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value. An investment normally qualifies as a cash equivalent only when it

has a short maturity of, say, 3 months or less from the date of acquisition.

Presentation of a Cash Flow Statement:

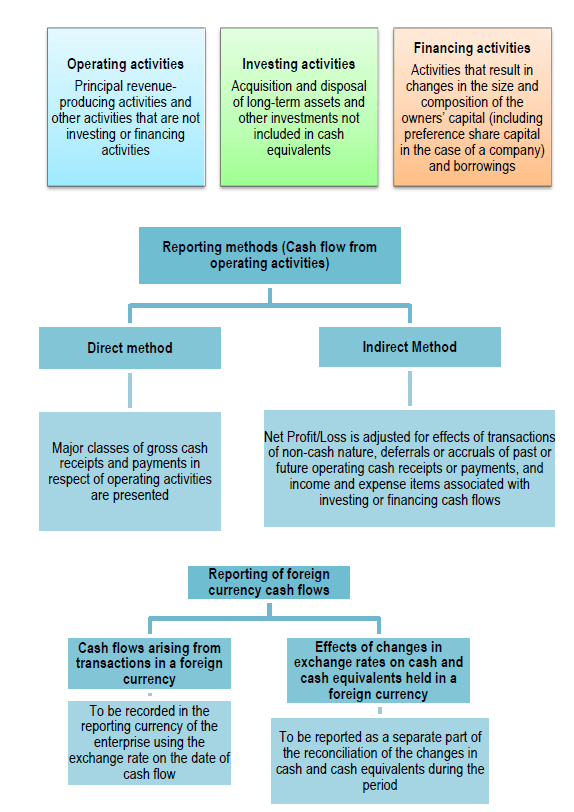

The Cash Flow Statement should report cash flows during the period classified by operating, investing and financing activities. The cash flows associated with extraordinary items should be classified as arising from operating, investing or financing activities as appropriate and separately disclosed.

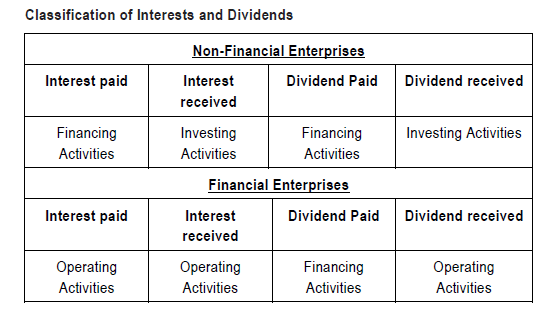

Classification of Interests and Dividends

Taxes on Income-Cash flows arising from taxes on income should be separately disclosed and should be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities.

Non-cash Transactions-Investing and financing transactions that do not require the use of cash or cash equivalents should be excluded from a Cash Flow

Statement. Such transactions should be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these

investing and financing activities.

Components of Cash and Cash Equivalents-An enterprise should disclose the components of cash and cash equivalents and should present a reconciliation of

the amounts in its Cash Flow Statement with the equivalent items reported in the balance sheet.