House Building Advance Interest Calculator

The House Building Advance Interest calculator is an easy-to-use online tool that helps you estimate your EMI and total interest based on your loan amount. We have updated our tool in line with the latest interest rates proposed by Ministry of Home Affairs.

Principal amount:

Interest rate:

Time (in months):

Interest:

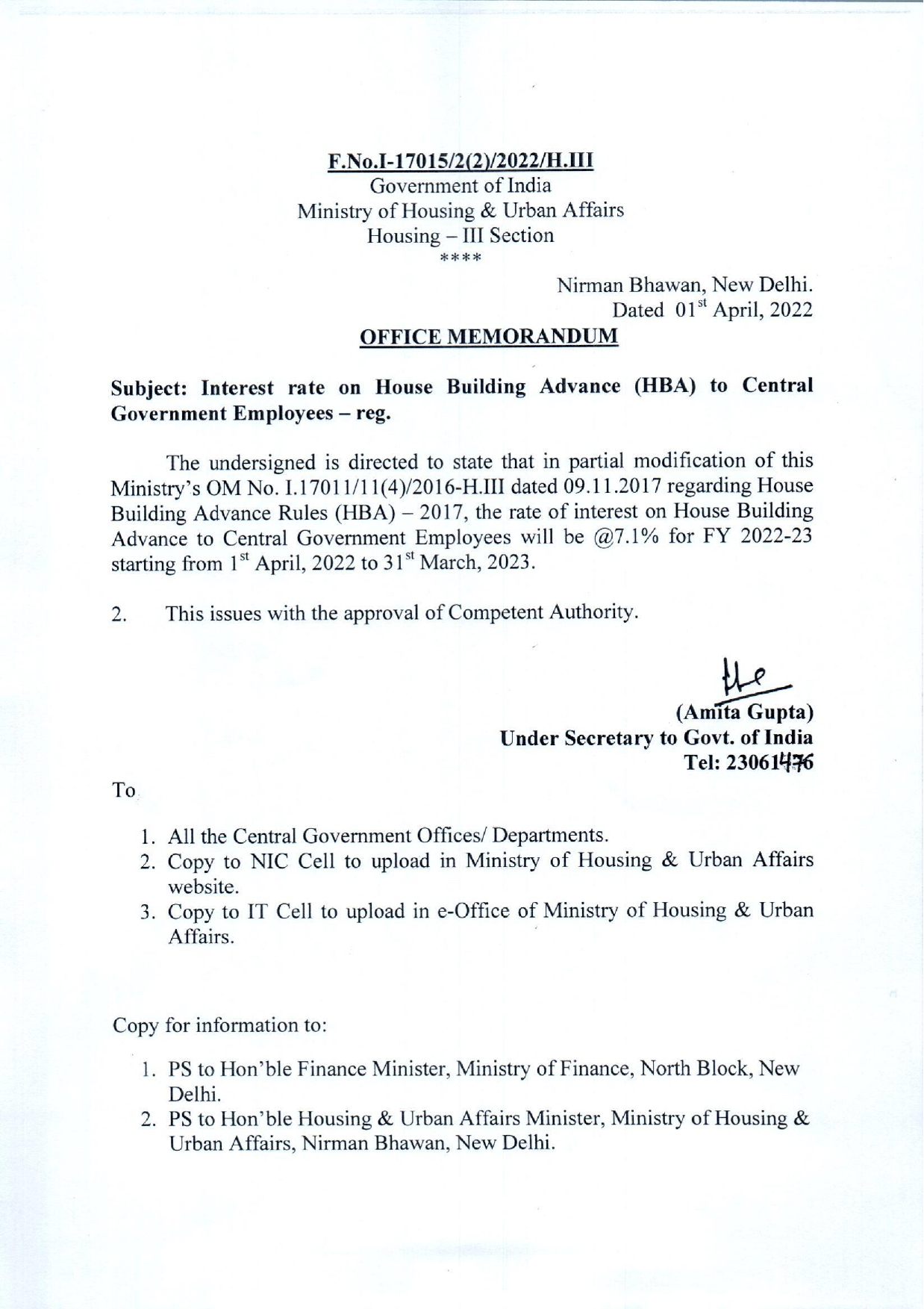

House Building Advance to Central Government Employees

1.The Scheme of House Building Advance to Central Government Employees is aimed at providing assistance to the Government employees to construct/acquire house/flats of their own. The scheme was introduced in 1956, as a welfare measure. Ministry of Urban Development & Poverty Alleviation act as the nodal Ministry for the same.

2. House Building Advance is admissible to all those temporary employees also who have rendered 10 years of continuous service. The Ministries/Departments are delegated powers to sanction House Building Advance to their employees in accordance with the House Building Advance Rules.

3.With effect from 27-11-2008, the following provisions of grant of House Building Advance shall be in operation, until further orders:-

(i).The maximum limit for grant of HBA shall be 34 months’ of pay in the pay band subject to a maximum of Rs. 7.50 lakh or cost of the house or the repaying capacity whichever is the least, for new construction/purchase of new house/flat.

(ii).The maximum limit for grant of HBA for enlargement of existing house shall be 34 months’ pay in the pay band subject to a maximum of Rs. 1.80 lakh or cost of the enlargement or repaying capacity, whichever is the least.

(iii).The cost ceiling limit shall be 134 times the pay in the pay band subject to a minimum of Rs.7.50 lakh and a maximum of Rs.30 lakh relaxable up to a maximum of 25% of the revised maximum cost ceiling of Rs.30 lakh.

4. The rate of interest on House Building Advance is between 5% to 9.5% ,depending on the loan amount.

5. The repaying capacity of Govt. servants who have more than 20 years of remaining service has been revised from 35% to 40% of pay. (Pay means pay in the pay band).

6. The salient features of House Building Advance Rules are as follows-

1. ELIGIBILITY

- Permanent Government employees.

- Temporary Government employees who have rendered at least 10 years continuous service.

- To be granted once during the entire service.

If both the husband and wife are Government of India employees and eligible for HBA, it shall be admissible to only one of them.

2. PURPOSE

HBA is granted for:

- Constructing a new house on the plot owned by the official or the Official and the Official’s wife/husband jointly.

- Purchasing a plot and constructing a house thereon.

- Purchasing a plot under Co-operative Schemes and Constructing a house thereon or acquiring house through membership of Co-operative Group Housing Scheme.

- Purchasing /construction of house under the Self-Financing scheme of Delhi, Bangalore, U.P., Lucknow etc.

- Outright purchase of new ready-built house/flat Housing boards, Development Authorities and other statutory or semi-Government bodies and also from private parties.*

- Enlarging living accommodation in an existing house owned by the official or jointly with his/her wife/husband. The total cost of the existing structure (excluding cost of land) and the proposed additions should not exceed the prescribed cost ceiling.

- Repayment of loan or advance taken from a Government or HUDCO or Private source even if the construction has already Commenced, subject to certain conditions.

- Constructing the residential portion only of the building on a Plot which is earmarked as a shop-cum-residential plot in a Residential colony.

* Private party means registered builders but not private individuals.

3. CONDITIONS:

a) The applicant or spouse or minor child should not already own a house in the town/Urban agglomeration where the house is proposed to be constructed or acquired.

b) The title to the land should be clear. The land may be owned either:- by the Government employee; or – jointly by the Government employee and spouse.

c) COST CEILING

134 times of pay in the pay band subject to a minimum of Rs. 7.50 lakh and a maximum of Rs.30 lakh

Administrative Ministry may relax the cost ceiling to 25% of cost ceiling mentioned above in the individual cases on merits.

(Effective from 27th November, 2008)

d) AMOUNT OF ADVANCE:

- will be the LEAST of the following:-

(i) 34 times the pay in the pay band.

(ii) The cost of construction.**

(iii) Rs. 7,50,000/- ***

(iv) Repaying Capacity.

** 80% of cost in rural areas.

*** Rs. 1,80,000/- in case of enlargement of existing house.

e) REPAYING CAPACITY:-

Repaying Capacity is computed on the following basis:-

| S. No. | Length of remaining service of the applicant. | Repaying Capacity |

| 1. | Retiring after 20 years. | 40% of pay @ |

| 2. | Retiring after 10 years but not later than 20 years. | 40% of pay @ plus 65% of * Retirement Gratuity |

| 3. | Retiring within 10 years | 50% of pay @ plus 75% of * Retirement Gratuity. |

@ Pay means pay in the pay band

4. DISBURSEMENT OF ADVANCE:

| S. No. | Purpose of HBA | Disbursement | |

| (1) | (2) | (3) | |

| (i) | For construction/enlargement (single or double storeyed). | 50% –50% | on execution of mortgage deedon construction reaching plinth level (Ground Floor). |

| (ii) | For purchase of land and construction (Single storeyed) | 40% or – actual cost 30% –30% – | for purchase of plot on execution of agreement and production of Surety Bond.On execution of Mortgage deed.On construction reaching plinth level. |

| (iii) | For purchase of land and construction (Double storeyed) | 35% or actual cost 32.5% –32.5% – | for purchase of plot on execution of agreement and production of Surety bond.On execution of the mortgage deed.On construction reaching the plinth level. |

| (iv) | For purchase of ready built house/flat | 100% – in one lumpsum. | |

| (v) | For acquiring flat/house from Co-operative Group Housing Society. | 20% – 80% – | Towards purchase of land by the Society.in suitable installments on receipt of demand (pro-rate basis) |

| (vi) | For purchase of flat under SFS of Development Authorities etc. | No payment for initial registration Deposit.May be released in not more than 5 instalments. But the fifth and final instalment should not be less than 10% and is to be released for making final payment. |

5. TIME SCHEDULE FOR UTILISATION OF HBA:

| S. No. | Purpose | Time limit |

| (a) | Purchase of registered plot on which construction can commence immediately. | Sale deed to be produced within 2 months. |

| (b) | Purchase of ready built house. | Acquisition and mortgage to Government to be completed within 3 months. |

| (c) | Purchase/construction of new flat | Should be utilised within one month of sanction. |

6. REPAYMENT OF ADVANCE:

The recovery of advance shall be made in not more than 180 monthly installment and interest shall be recovered thereafter in not more than 60 monthly installments. In case Government servant is retiring before 20 years, repayment may be made in convenient installments and balance may be paid out of Retirement Gratuity.

7. INTEREST

The rate of interest on Housing Building Advance with effect from 1st April, 2003 are as follows:-

| S. No. | Amount of Advance sanctioned to a Government Servant | Rate of Interest on HBA (Per Annum). |

| 1. | Upto Rs. 50,000/- | 5% |

| 2. | Upto Rs. 1,50,000 | 6.5% |

| 3. | Upto Rs. 5,00,000/- | 8.5% |

| 4. | Upto Rs. 7,50,000/- | 9.5% |

8.COMMENCEMENT OF RECOVERY:

| Construction of a house or enlargement of living accommodation | * From pay for the month following the completion.OrThe pay for the 18th month after date of payment of the 1st installment, whichever is earlier. |

| Purchase of land and construction. | * From pay for the month following the completion of the house.OrThe pay for the 24th month after date of drawl of installment for purchase of land, whichever is earlier. |

COMMENCEMENT OF RECOVERY(CONT’D):

| Ready built flat. | * Pay for the month following the month in which advance was drawn. |

| Purchase of Flat under SFS from Development Authority/Housing Society. | * From the pay for the 18th month after date of payment of 1st installment. |

* The sanctions of HBA should invariable stipulate a higher rate of interest at 2.5% above prescribed rates with the stipulation that if conditions attached to the sanction are fulfilled, rebate of interest to the extent of 2.5% will be allowed.

9. CREATION OF SECOND MORTGAGE:

The Government servants who have obtained HBA from the Government may be permitted to create a second charge on the property provided they obtain prior permission of the Head of the Department and the draft deed of second mortgage is submitted to the Head of the Department for scrutiny. Such a second charge may be created only in respect of loans to be granted for meeting the balance cost of houses/flats by recognised financial institutions.

10.PROVISIONS FOR SAFE RECOVERY OF HOUSE BUILDING ADVANCE:

(i). As a safeguard of the House Building advance, the loanee Government employee has to insure the house immediately on completion or purchase of the house, as the case may be, at his own cost with Life Insurance Corporation of India and its associated units. The house/flat constructed/purchased with the help of House Building advance can also be insured with the private insurance companies which are approved by Insurance Regulatory Development Authority(IRDA). However, the insurance should be taken for a sum not less than the amount of advance against damage by fire, flood and lightning, and has to be continued till the advance together with interest is fully repaid to Government.

(ii).The house constructed/purchased with the help of House Building Advance has also be mortgaged in favour of the President of India within a stipulated time unless an extension of time is granted by the concerned Head of the Department. After completion of the recovery of the advance together with interest thereon, the mortgage deed is re-conveyed in a proper

manner.